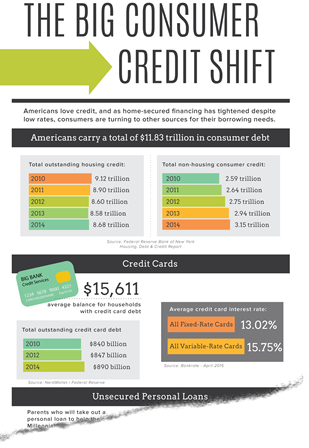

Total credit card balances have grown steadily the past four years and total unsecured personal loans from nonbank lenders such as loanDepot have grown exponentially from $1.2 billion in 2012 to $8.8 billion in 2014 – with even more growth expected this year and beyond.

Student and auto loan debt have also grown, with student loans totaling $1.325 trillion in 2014, up from $912.4 billion in 2010.

Despite historically low mortgage rates, housing credit has become much harder to get for many Americans – a major factor in shift in demand toward non-mortgage credit. Of course, total housing debt is still more than double non-housing consumer credit total, but that's to be expected as homes cost significantly more than any other items we finance.

A loanDepot licensed loan officer can help with these and any other lending questions. Call (888) 983-3240 to speak with one today.

Click image to open graphic

RELATED TOPICS

5 ways to benefit from a home loan refinance

9 helpful ways to use an unsecured personal loan

The Bank of Mom & Dad is alive and growing

7 financial mistakes to avoid in your 20s

Back to Knowledge Cafe