Last week on one of the lending industry’s biggest stages—2018 MBA Tech in Detroit—loanDepot technology chief Dominick Marchetti as well as marketing SVP and VP Julian Hebron and Kamran Baktiari laid out the future of customer experience for homebuyers and owners.

Dom runs the only technology team in all of fintech that’s delivered a platform to handle not only mortgage and non-mortgage loans from customer application through closing, but also enables customers to seamlessly connect with real estate agents and home improvement pros for a one-stop shop housing experience.

Here are a few notable trends from Dom during his talk on stage:

- This is the most exciting time in two decades as technology finally enables customers to get exactly what credit they need when they need it, and do as simply as they do other things like buy lightbulbs from Amazon or order a ride from Uber.

- Our customer isn’t just a mortgage borrower. It’s the U.S. homeowner who also needs real estate, insurance, personal loans, home improvement, and other services throughout their home buying and owning lifecycle. Because all customer information is now digital rather than paper as in the past, data enables us to serve our customers through this home owning lifecycle.

- In the years since the financial crisis, average costs for U.S. lenders to originate a loan have spiked. But this will now drop as direct-to-source data and other technology to streamline the loan process is adopted by customers and allowed by investors/regulators. Customers will benefit from better pricing as this plays out.

- Now more than ever, big lending is Big Tech. As the nation’s fifth largest lender, we’re solving the biggest problems in finance, and we need the brightest technology to do it. Our world-class facilities and culture are built like Big Tech firms to attract and retain this talent.

In addition to Dom’s talk, Julian and Kamran also gave a talk on how technology is changing customer expectations in homeownership, and how loanDepot has shaped its strategy around these three market themes to better serve customers:

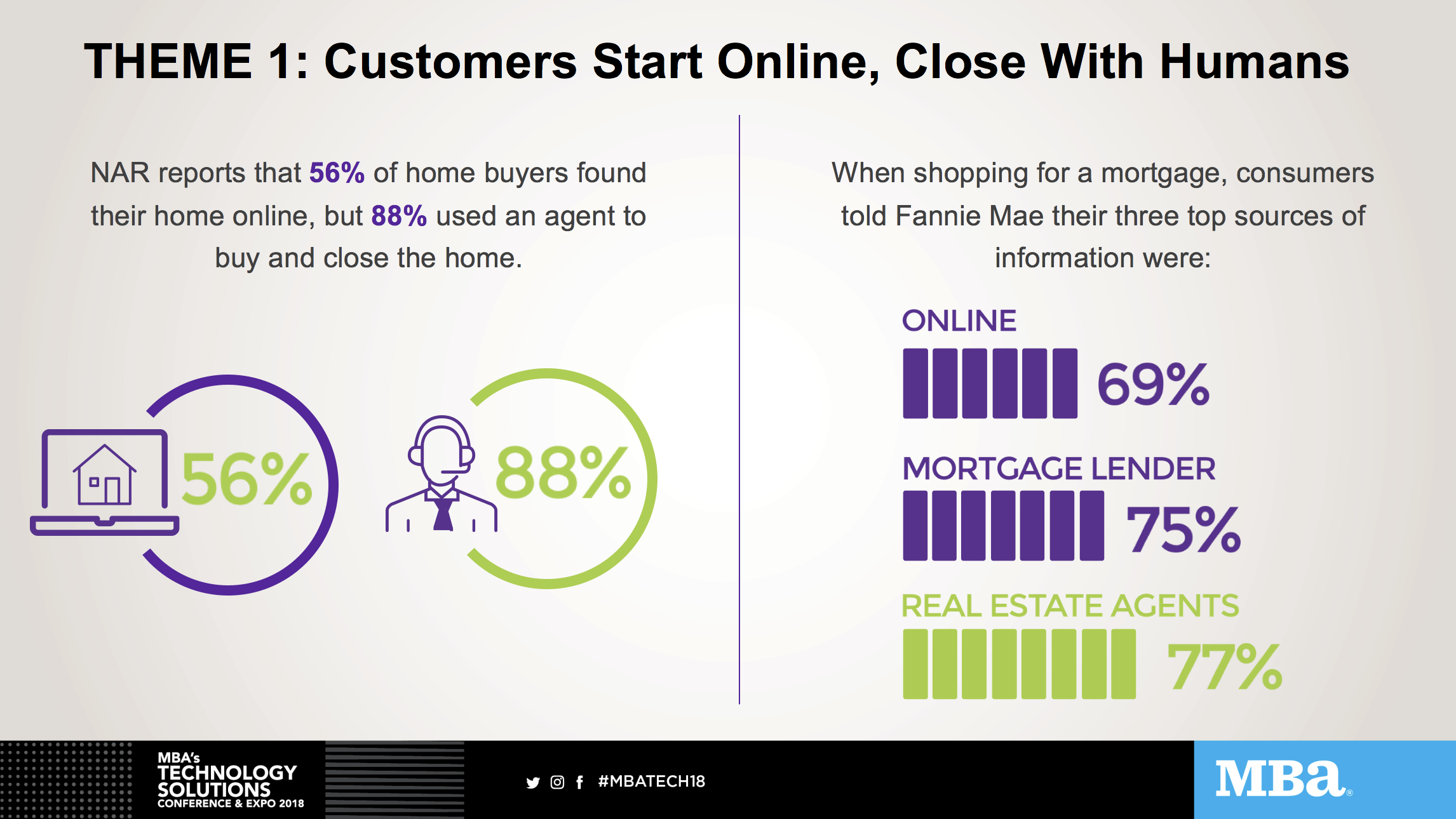

THEME 1: When it comes to real estate transactions, customers expect digital simplicity paired with local expertise. They are more likely to start the home buying and financing process online, but close with humans.

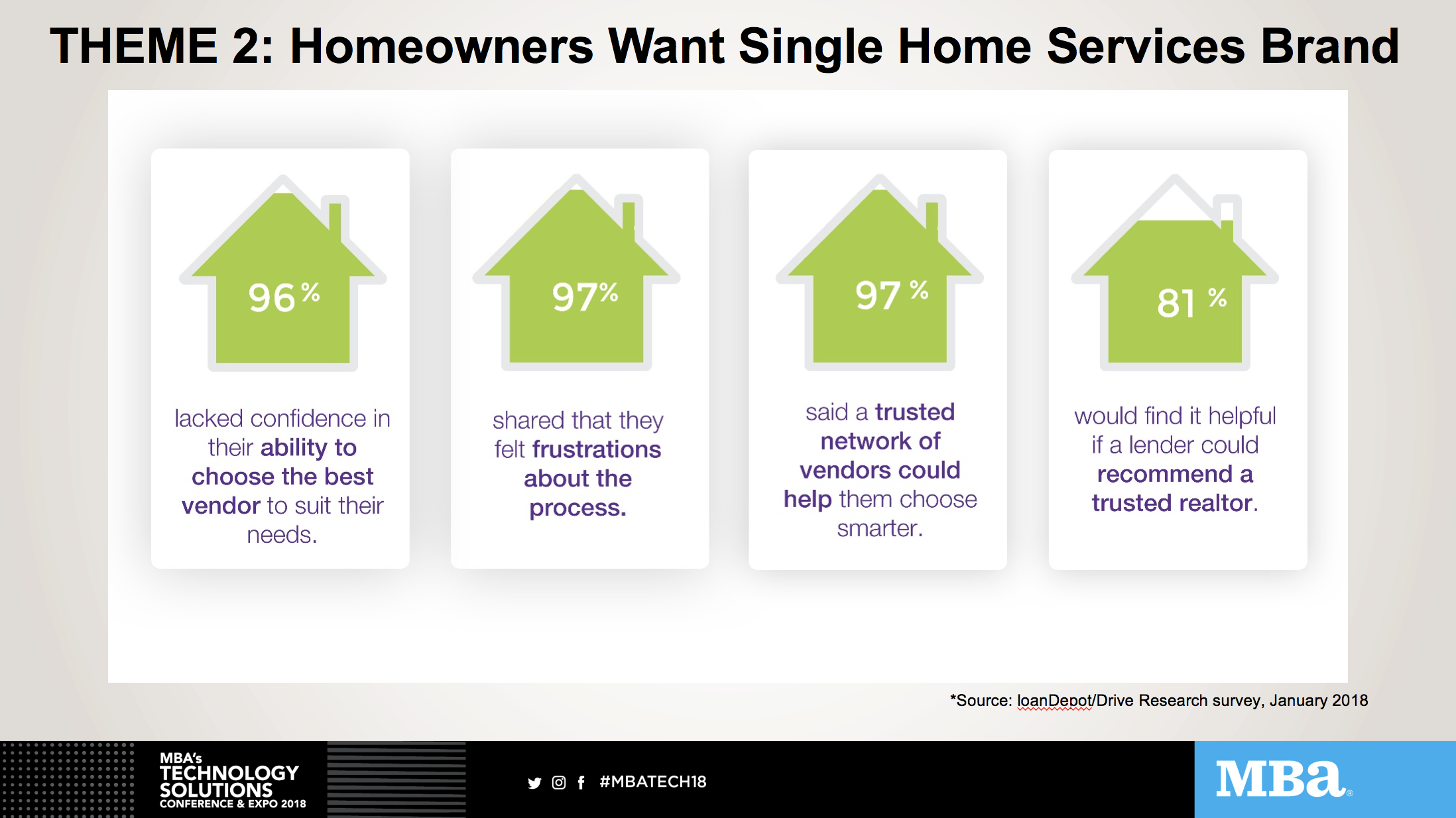

THEME 2: Homebuyers eventually need and want all housing services—real estate, lending, and home improvement—and increasingly they expect to be able to source these services from one place.

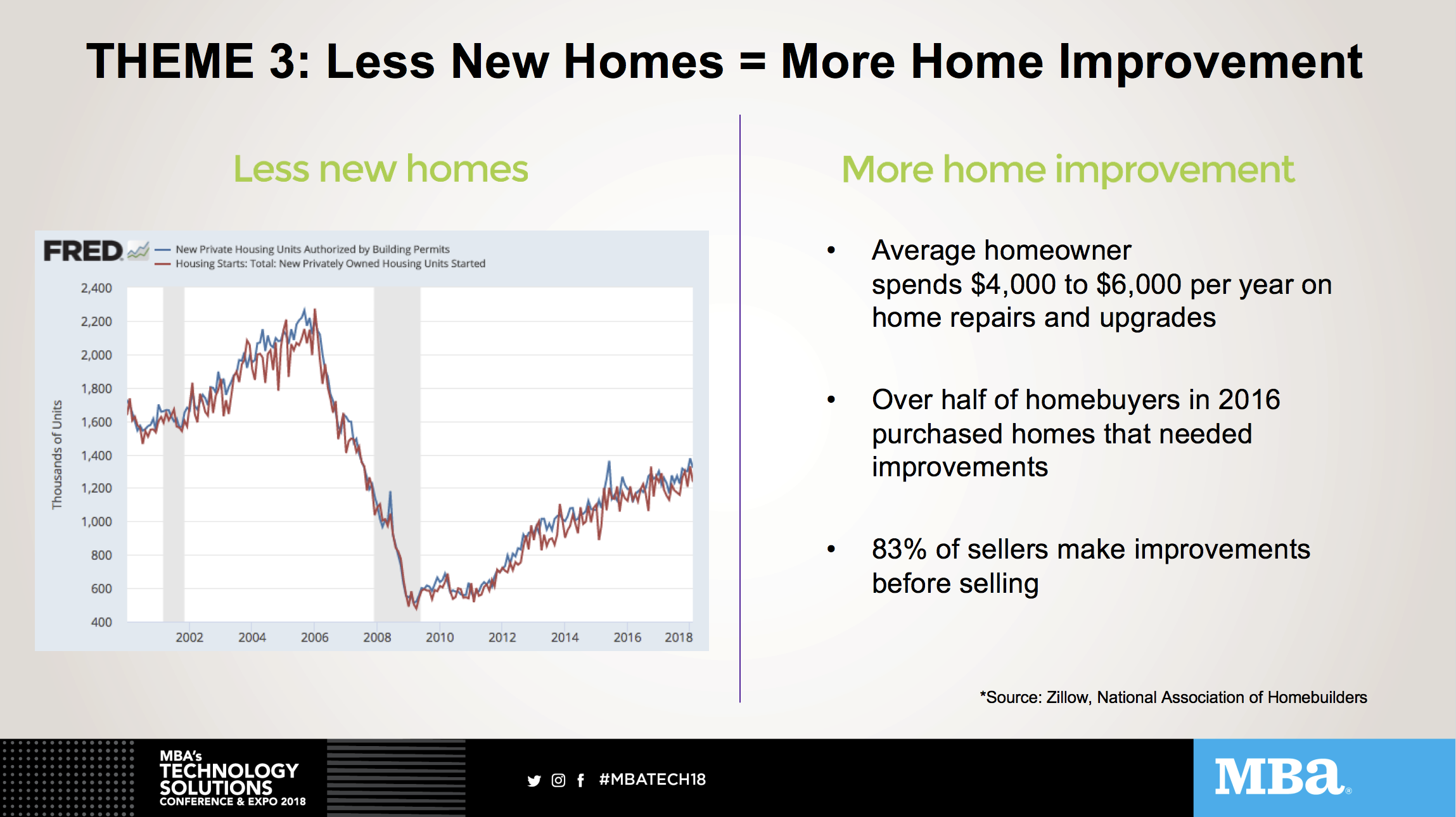

THEME 3: Less homes available means more home improvement: while home building has improved since bottoming 10 years ago, inventory is still short some home buyers and sellers are spending a lot on home improvement and need advice and financing

We’re honored to serve you, and we invite you to engage with us for your homeownership needs.

Back To Blog

Back To Blog